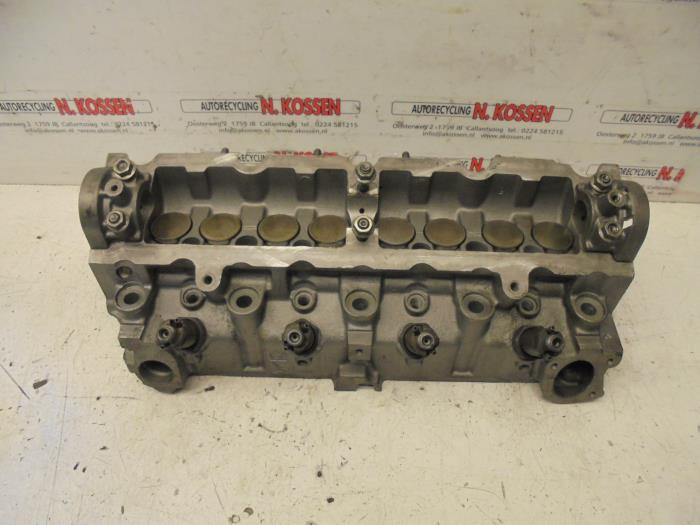

Culasse complete pres a monter verifier psa 1.9d dw8 e3xpert scudo jumpy berlingo partner c15 - Équipement auto

VENTES DE VOITURE OCCASION 4X4 2ROUES BATEAUX OU PIECES DETACHEES TAHITI PF | Vend une culasse complet pour Peugeot partner 1.9l moteur DW8

Moteur CITROEN JUMPY XSARA BERLINGO FIAT SCUDO PEUGEOT PARTNER EXPERT 206 306 1.9L Diesel - Moteur Livré - Livraison de moteur de toutes marques

Culasse complete pres a monter verifier psa 1.9d dw8 e3xpert scudo jumpy berlingo partner c15 - Équipement auto