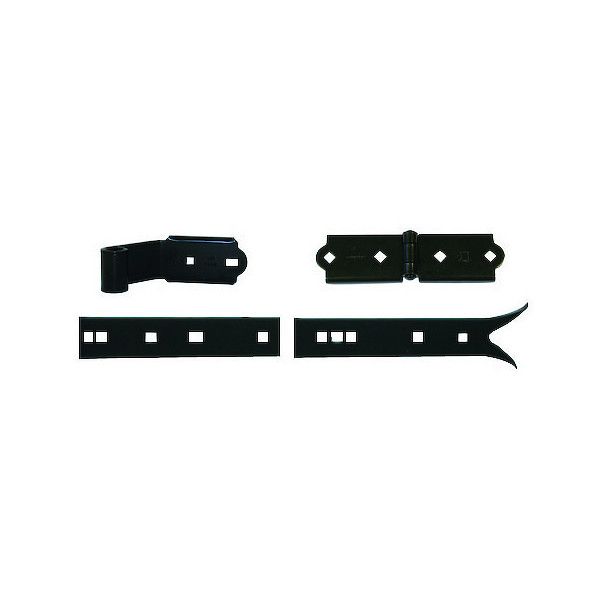

Ensemble de charnière pour penture de volet battant 1538C - Largeur : 35 mm - Longueur : 750 mm - Diamètre du nœud : 14 mm - Finition : noir - Queue de carpe - TORBEL INDUSTRIE | PROLIANS

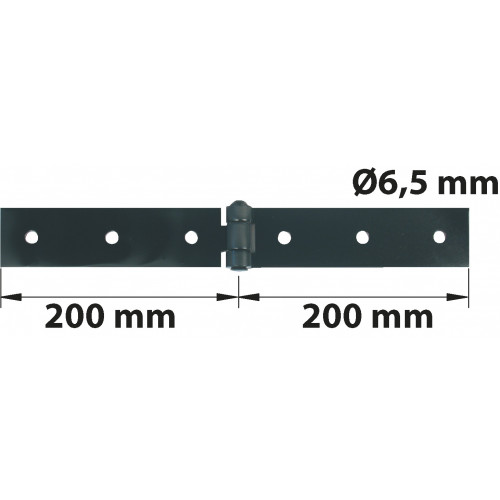

Charnière de jonction - BATIFER, quincaillerie professionnelle, spécialiste du bâtiment et de l'agencement