ساخته شده توسط تیم PixFort

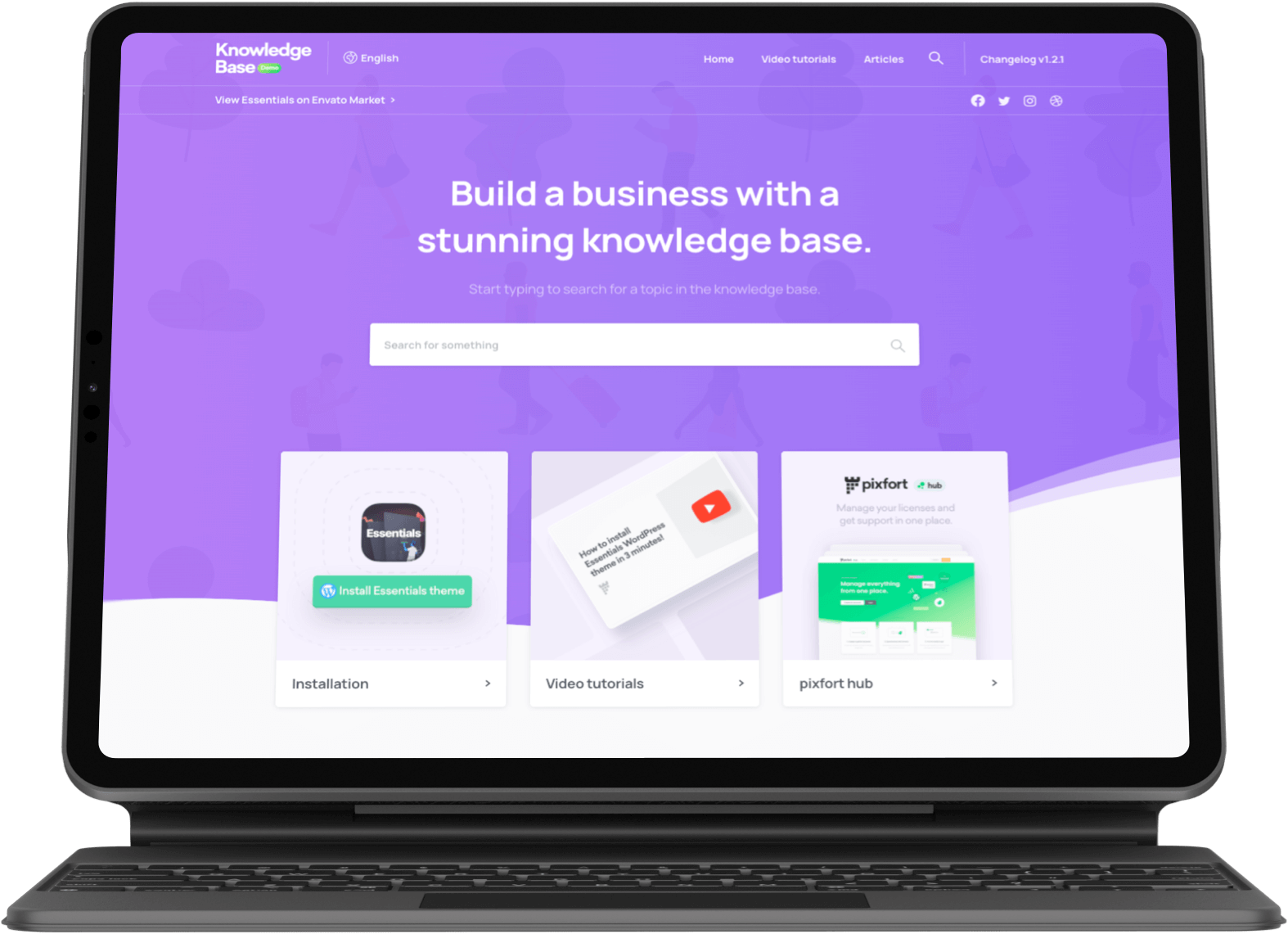

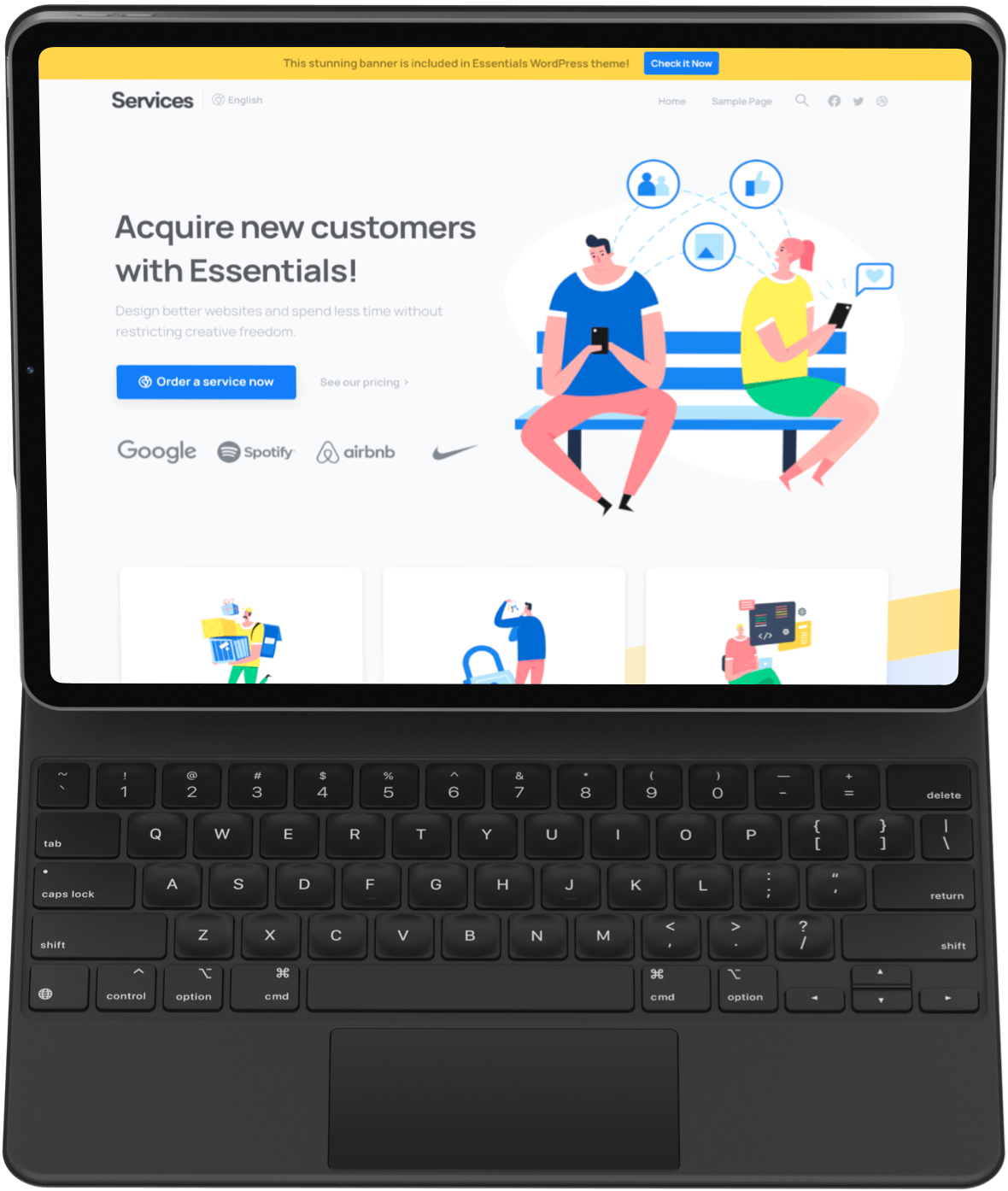

وب سایت های زیبا را در کوتاه ترین زمان طراحی کنید!

با قالب اسنشال شروع کنید به ساخت وب سایت های زیبا و مدرن

سرعت لود بسیار بالا

طراحی چشم نواز

شخصی ساز تصاویر

وب سایتی بسازید که برای هر کسب و کاری مناسب است.

کد نویسی ممنوع

ارتباط امن

تحویل سریع

+0

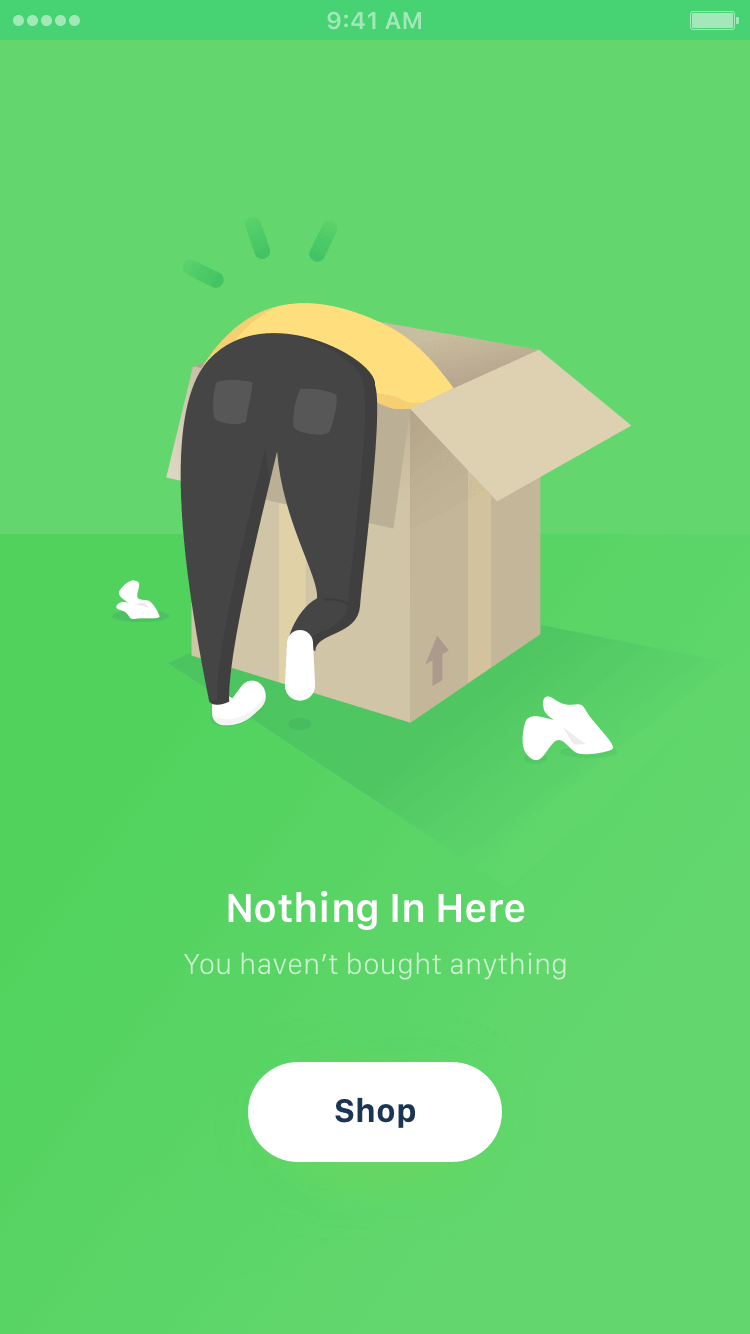

دوربین های پیشرفته همراه با یک نمایشگر بزرگ، عملکرد سریع و سنسورهای بسیار کالیبره شده، iPad را به دستگاهی منحصر بفرد تبدیل کرده است.

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است .

مححد اسلامی

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است .

هلیا اکبری

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است .

احسان شوندی

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم است.

پوریا روشن

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است .

نرگس عبدی

با اسنشال شروع به ساخت وبسایت های جذاب کنید.

وب سایت های زیبا را خلق کنید

با اسنشیال ساخت وب سایت های خیره کننده را شروع کنید.

ساخت پیشرفته ترین و حرفه ای ترین پلان ها و جداول بدون حتی یک خط کد نویسی و نیاز به تجربه. تنها با چند کلیک و در چند دقیق.

ساخته شده توسط تیم PixFort

با خیالی آسوده انتخاب کنید !

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است.

تایید شده توسط PixFort

شخصی ساز تصاویر

ساخته شده توسط تیم PixFort

برخی از قابلیت های ویژه را کشف کنید !

ساخت و ارائه محصولات به بهترین نحو با استفاده از پیشرفته ترین و منحصر بفردترین قالب وردپرسی موجود !

ضبط ویدیو ها